View – Long Term Investors Can Apply

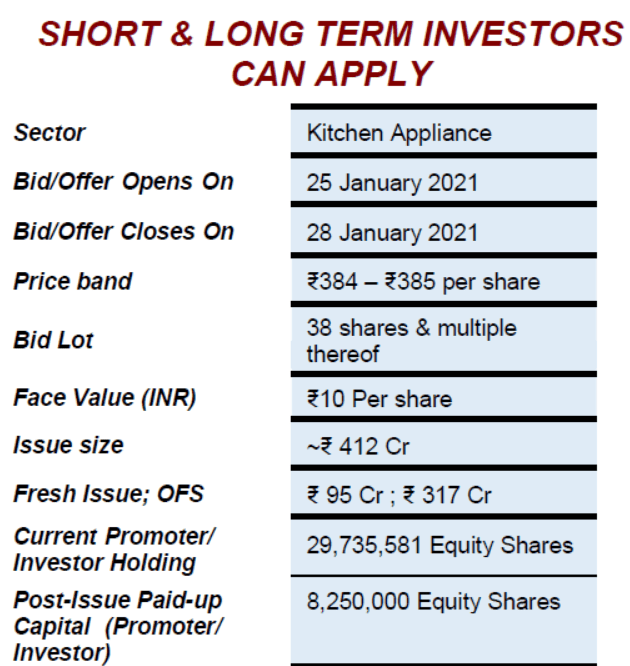

Issue Highlights

Ashapuri Gold Ornament Limited is all set to come up with a second round of public offer, with a goal to raise funds of INR 30 crores. It is already listed on BSE SME Platform.

Issue Details

Company Strengths

- Good reputation and trust in the market

- Most designs are very antique and unique

- Showroom located at a prime location – C.G Road, Ahmedabad

- Understanding of Customer Preferences

- Supplier to Reputed Retail Show Rooms (Companies)

- Experienced promotors with two decades of experience in jewelry industry.

Weakness

- Limited geographical area of Operations

- Family owned unit resulting in Lack of Professionalism.

- Uncertainty in market fluctuations

Opportunities

- Started in house manufacturing unit

- Tie-up with large chain jewelry retail stores for supply of jewelry

- Recruitment of sales team to cover the wide region.

Threats

- May face competition from organized and unorganized sector.

- Dealing in lifestyle products, economic slowdown will reduce the demand and hamper the growth of the Company.

- Fluctuation in raw material, since the prices are going up and there‘s volatility in prices of gold.

Valuation

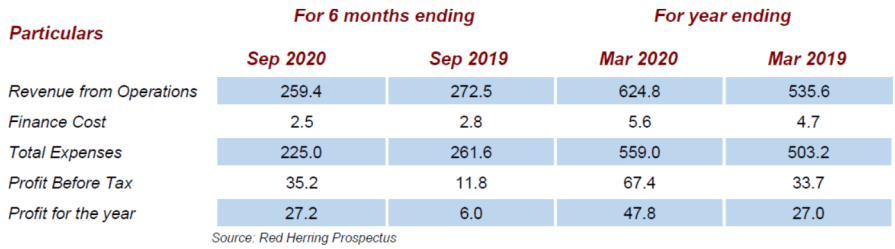

The company reported its EPS at INR 1.15 for the period ending on September 2020. The company is getting listed at a PE of 35.2x on the basis of annualized FY 21 EPS.

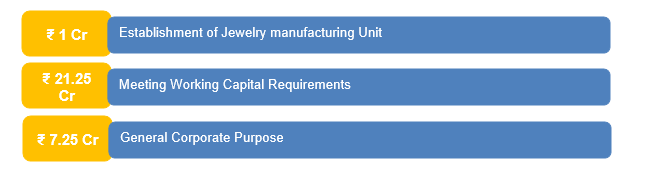

Utilization of Funds

Background highlights of the Company in brief

- Ashapuri Gold Ornament Ltd was originally incorporated as Ashapuri Gold Ornament Private Limited, as a private limited company under the provisions of Companies Act, 1956.

- Subsequently, it was converted in to a public limited Company pursuant to a special resolution passed by the company’s shareholders at the EGM held on January 09, 2019 and consequently the name was changed to Ashapuri Gold Ornament Limited.

- On March 27, 2019, shares of the company got listed and traded pursuant to Initial Public Offering on SME Platform of BSE Limited.

- The company is reckoned as one of the prominent manufacturer and wholesaler of gold jewelry.

- It has been 20 years of this remarkable journey serving jewelers from metro cities to even many parts of urban locations and unrivalled quality of jewelry.

- The company’s manufacturing expertise, large inventory of designs & high quality of service has made it possible to be in league of top jewelry suppliers.

- The company’s exquisite collection is spread across the Indian markets.

- The Company is engaged in the business of wholesale trading of Jewelry. The Jewelries are manufactured on Job-work basis at Ahmedabad and Rajkot.

- It has a showroom of 2945 sq. feet on prime location of C.G. Road, Ahmedabad, the newly developed main market for buying Gold and Diamond Jewelry.

- The Company has also purchased premises at Navrangpura, Ahmedabad, measuring 2194.02 sq. ft for starting manufacturing unit in the month of March 2019.

- The company’s product portfolio includes Wedding Jewelry, Festive Jewelry, Rings, Chain, Earrings, Ear Chain, Nose-rings/Nose pins, Waist belts, Mangalsutra, Anklet, Zuda, Toe Ring, Pendant Set/ Pendant, Bracelet and Bangles.

- It has appointed sales team for different region/city like Delhi, Rajasthan, Punjab, Uttar Pradesh, Kolkata, Chennai, Bangalore, etc for further expansion of business.

- As on November 30, 2020, the Company had employed 108 employees (including skilled, semi-skilled and unskilled employees).

Briefing about directors & Key Managerial Personnel

Briefing Financials

Balance Sheet

Statement of Profit and Loss

Key Ratios

#beelinebroking #SMEFPO #AGOL #AshapuriGoldOrnamentsFPO #Gold #Jewelry #PreciousMetals #investor #investing #profit #business #trader #stock #sharemarket #daytrader #bsesmeipo #daytrading #wealth #stockmarketnews #success #bse #SME #FPO

Disclaimer: beelinebroking.com/disclaimer.html